SAY YES TO OPPORTUNITY SCHOLARSHIPS

Be a Dream Maker: Support Opportunity Scholarships

We are here to make a difference in the lives of low-income children and we need your support!

Connecticut spends more money per child on education than almost any other state. But even as Connecticut’s affluent towns boast some of the highest-performing schools in the nation, our state suffers from one of the largest “education gaps” in the country.

Learn more about how you can help. Join us on March 25 at the Hartford State Capitol for Opportunity Day at the Capitol. We’ll be on the South Lawn from 9:00 am – 2:00 pm. For more information, read our press release.

Connecticut has the second worst reading and the fifth worst math gap between low-income and non-low-income fourth graders in the country.

The state also has the third worst math and the fourteenth worst reading gap between low-income and non-low-income eighth graders in the United States.

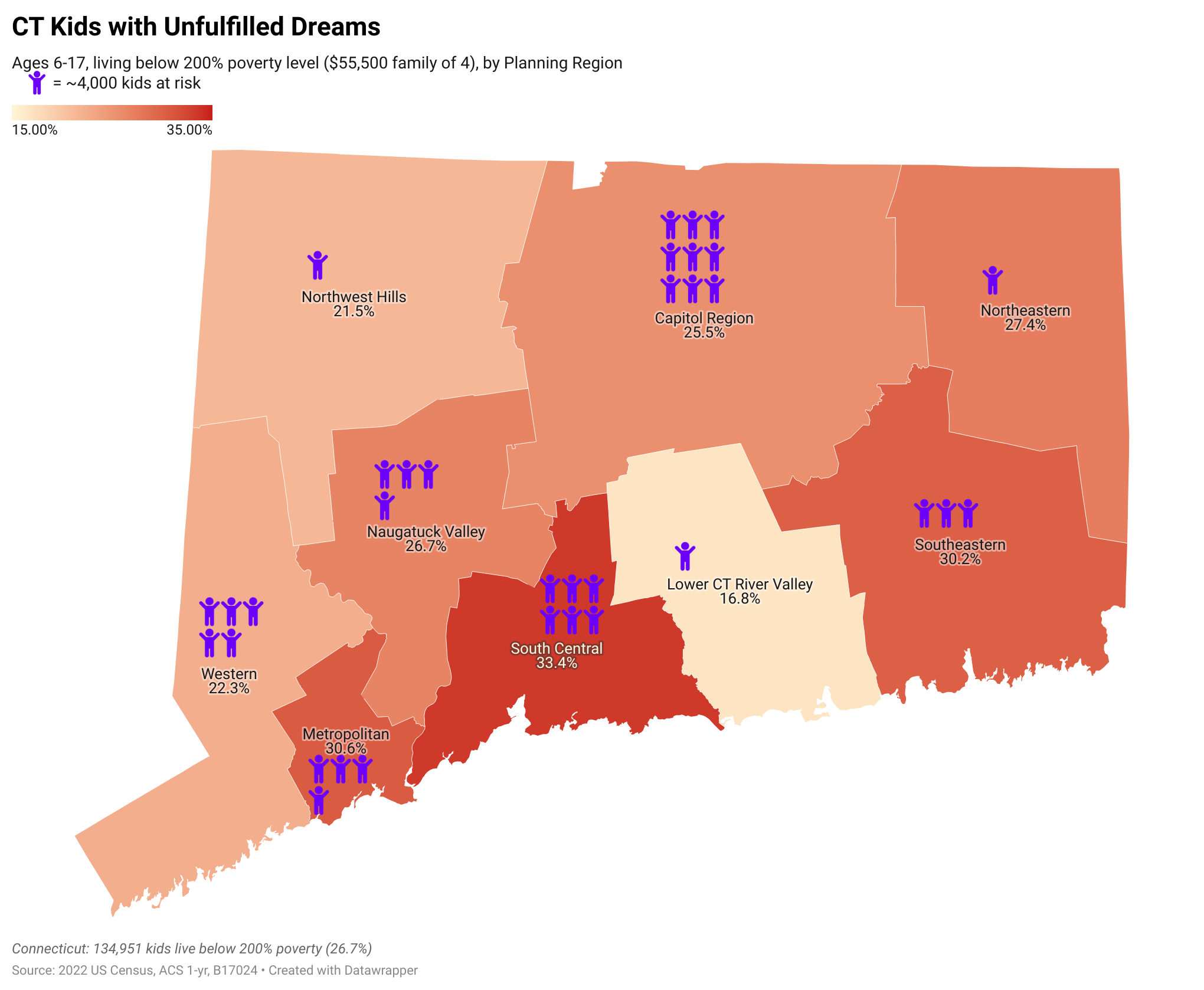

Connecticut’s low-income children are being left behind in failing public schools — and many of their families are desperate for alternatives. A tax-credit scholarship program (like the one offered by CTCEE) would offer educational opportunity to more than 150,000 of CT’s children, who — with families below 250% of the Federal Poverty line — lack the resources to escape failing schools.

How You Can Help Make Dreams Come True

There is a small step that could offer these students the same educational opportunity and access the children of our affluent residents enjoy: tax-credit scholarships. And they do it without taking a penny from our public schools.

Every child deserves the opportunity to attend a school that honors his or her uniqueness — and every parent deserves the opportunity to decide what kind of education best meets the needs of their children. Tax-credit scholarships help low-income families access the same educational opportunities that affluent families seek to empower their children.

Opportunity Scholarships Have a Track Record of Success

Students in 20 other states (including our neighbors in Rhode Island and Pennsylvania) benefit from tax-credit scholarships. Learn about programs in other states.

To understand just how eager Connecticut’s low-income families are for the opportunities these scholarships provide, let’s look at what happened when the Connecticut Center for Educational Excellence (CTCEE), the first state-wide scholarship granting organization, opened its doors last March: In three months, CTCEE received applications from over 900 low-income families in nearly 80 municipalities across the state.

Here are a few examples of the differences these scholarships are already making in the first year:

How can tax-credit scholarships make even more of these stories and dreams come true?

Wealthy families can access educational opportunities of their choice and benefit from tax incentives when they invest in their children’s education. Tax-credit scholarships extend this benefit to low-income families.

Tax-credit scholarships allow taxpayers to receive full or partial tax credits when they donate to nonprofits that provide K-12 school scholarships. Eligible taxpayers can include both individuals and businesses. In some states, scholarship-giving nonprofits also provide innovation grants to public schools and/or transportation assistance to students choosing alternative public schools.

Learn more about how CTCEE is helping to expand educational opportunities in Connecticut here.

CT Kids With Unfulfilled Dreams

Learn More About Opportunity Scholarships:

Basic definition:

Tax-credit scholarships allow taxpayers to receive full or partial tax credits when they donate to nonprofits that provide K-12 school scholarships. Eligible taxpayers can include both individuals and businesses. In some states, scholarship-giving nonprofits also provide grants to public schools and/or transportation assistance to students choosing alternative public schools.

Why is reform needed?

Some schools don’t work for every student. Kids are unique and need individual help. Children from low-income families, with individual needs, harmed by bullying, who are non-English native speakers, or who are otherwise disadvantaged deserve the educational opportunities this reform allows them to access. See a recent CTCEE study done by UNH student researchers on CT’s “education gap.”

Linnea, an 8th grader from Baltic says, “My dream is to be a computer programmer to one day help make technology more affordable for everyone.” She received a scholarship for the 2023-2024 school year and because of that, we are helping make this dream possible!

CTCEE Scholars’ Dreams

With your help, we can fulfill the dreams of CTCEE’s scholars. Here are some of their dreams…

- My dream is to be a computer programmer to one day help make technology more affordable for everyone.”

- My dream is to become a firefighter. - Grade 1, Hartford

- My dream is to be a police officer.

- When I grow up I would like to be an architect. I thought about this when I was a 4 year old, building with Legos. - Grade 4, Hartford

- I want to be an artist when I grow up. I want to draw animals and people, and give the drawings to kids in other countries. - Grade 5 from Manchester

- My dream is to become a Doctor so that I can help people feel better.

- When I grow up I want to be a police officer, helping the community, and helping to stop crime. I want to show my mom that I can do this, and maybe even become a sheriff or sergeant. - Grade 8 from Bloomfield

- I want to be the boss of my own company, designing clothes for people so they can look good all day long. Grade 7 from Manchester

- My dream is to become a surgeon, helping people who could basically die without help. This college prep school can help me achieve my goal to get into a good college. - Grade 7 from Hartford

- My dream is to be an art teacher so that I can help students be creative.

- My dream is to be a nurse so that I can provide care for sick people.

Looking for even more?

Related Previous CT Legislation:

- HB 6941 (2023), regarding the state budget, initially included Section 390 – Tax Credit for Cash Contributions to Scholarship Organizations for Private Schools (See OLR’s initial Bill Analysis):

- The credit may be applied against the corporation business tax or personal income tax, but not the withholding tax. The credit equals 50% of the qualifying contribution, up to a maximum of $100,000 credit per income year for corporation taxpayers or $20,000 credit per tax year for personal income taxpayers. The bill caps the total amount of credits that may be reserved for this program at $2.5 million per fiscal year.

- “Eligible students” are school-aged students (1) registered in a qualified school and (2) with household income of up to 250% of the federal poverty level (FPL) (e.g., up to $75,000 for a family of four based on the current FPL). To qualify for a credit, the person or business making a contribution may not designate any part of it to a specific qualified school or student.

- Other CT Legislation:

Information from Other Sources:

- EdChoice: What is a Tax-Credit Scholarship?

- US GAO: Accountability in State Tax Credit Scholarship Programs

- ExcelinEd: Tax Credit Scholarships

- General information:

- In 2022, there were 325,168 students utilizing these scholarships in 21 states. See their success stories.

- There are currently 25 programs in 20 states.

- Examples include:

- New Hampshire (enacted in 2012)

- Examples include:

-

-

-

- 1,717 participating students in 2021-22

- 68 participating schools

- Avg. scholarship value: $2,106

- Tax credit is 85% of donation value.

- Students must be between ages five and 20 and come from households where family income is less than 300% of the federal poverty level.

-

-

-

-

- Rhode Island (enacted in 2006)

-

-

-

-

- 470 participating students in 2022

- 51 participating schools

- Avg. scholarship value: $2,890.

- Tax credit is 75-90% of donation value.

- Students must have family incomes at or below 250% of the poverty level.

-

-

-

-

- Pennsylvania (enacted in 2001)

-

-

-

-

- 44,737 participating students in 2020-21

- Avg. scholarship value: $2,554

- Tax credit is 75-90% of donation value.

-

-

-

-

-

- Children are eligible for scholarships if their household incomes are less than $105,183 plus $18,514 for each child in the family in 2022–23.

-

-

-

-

- Ohio (enacted in 2021)

-

-

-

-

- All students are eligible to receive these scholarships.

-

-

-

-

- Florida (enacted in 2018)

-

-

-

-

- 249 participating students in 2021-22

- 1,425 eligible schools

- Avg. scholarship value: $7,300.

- Students in grades K–12 who are victims of bullying or violence in public district schools are eligible for Hope Scholarships.

-

-